Cashflow Forecasting: The Secret to Staying in Control

Cashflow forecasting and budgeting. Two things that many business owners—especially in times of plenty—tend to push down the priority list. When cash is flowing in steadily, it’s easy to assume things will stay that way.

But here’s the reality: Cashflow doesn’t just manage itself. Businesses that don’t forecast their cashflow often find themselves blindsided when the good times slow down. And they always slow down.

Just ask the businesses that hit a brick wall during COVID-19. Practically overnight, revenue streams dried up, yet payroll, supplier invoices, and loan repayments kept rolling in. Those without a clear cashflow strategy were left scrambling.

If your business isn’t actively forecasting its cashflow, you’re not in control of your finances—you’re just reacting to them.

The Data Speaks for Itself

The statistics paint a stark picture:

82% of small business failures are due to cashflow mismanagement. (U.S. Bank Study)

More than 50% of businesses struggle to pay their tax obligations on time due to poor cashflow planning. (ATO Data)

Businesses with a structured cashflow management system grow 30% faster than those without. (Australian Small Business and Family Enterprise Ombudsman)

This isn’t about theory—it’s about survival and growth. The businesses that manage cashflow well aren’t just the ones that stay afloat; they’re the ones that scale and thrive.

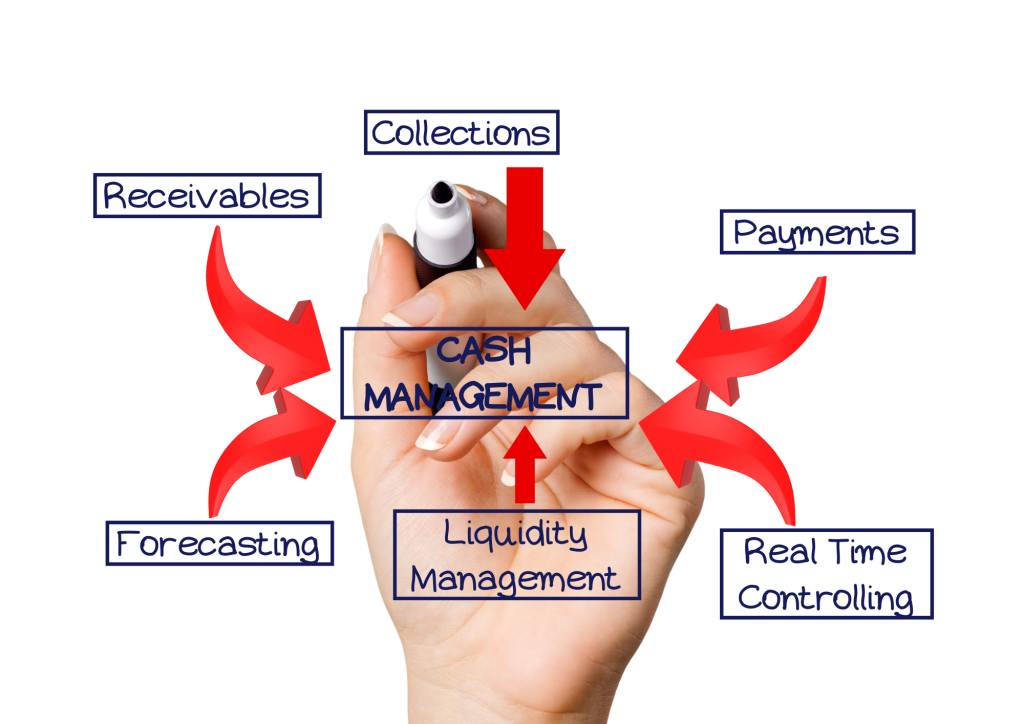

Cashflow Forecasting with a Structured Approach

82% of business failures are due to poor cashflow management. The businesses that plan ahead are the ones that survive and thrive

At its core, cashflow forecasting is about predictability—understanding how much cash will be available in the short, medium, and long term. A good forecast doesn’t just tell you what’s happening; it gives you time to act before cash shortages become crises.

However, most businesses get this part wrong. They focus on revenue and expenses but forget to allocate cash into key categories before spending.

Instead of letting cash dictate decisions, we take a structured approach:

1️⃣ Income is divided into key business needs as soon as it comes in.

2️⃣ Funds are set aside for tax obligations, operating expenses, and future growth, ensuring nothing is left to chance.

3️⃣ Business owners know exactly what’s available for reinvestment, wages, and profitability.

This isn’t just cashflow forecasting—it’s cashflow control.

Why Cashflow Forecasting is a Business Essential

A cashflow forecast isn’t just a finance tool—it’s a decision-making powerhouse. When done correctly, it:

Prevents nasty surprises – No more last-minute scrambles for cash to pay tax bills, wages, or supplier invoices.

Gives businesses leverage – Companies with strong cashflow forecasting can negotiate better loan terms and investment deals.

Drives strategic growth – You can confidently reinvest in your business, knowing cash will be there when you need it.

Eliminates financial stress – When you know your cash position in advance, financial decision-making becomes proactive, not reactive.

For business owners like Sarah (who runs a legal consultancy) or Michael (who manages a construction firm), the difference between cash clarity and cash chaos is the difference between sleeping soundly or lying awake at 2 AM

The Biggest Cashflow Mistakes Businesses Make

Despite the benefits, many businesses avoid cashflow forecasting. Why?

1️⃣ They confuse profit with cashflow – Just because your P&L statement shows a profit doesn’t mean you have cash in the bank.

2️⃣ They assume revenue solves everything – A business can be growing fast but still be cash-poor if spending is unstructured.

3️⃣ They don’t plan for taxes – Too many businesses treat tax bills as a surprise rather than an expected obligation.

4️⃣ They take a reactive approach – Only looking at the bank balance when bills are due leads to constant financial firefighting.

The biggest misconception? That cashflow forecasting is only necessary for struggling businesses. In reality, the most successful companies use it to stay ahead.

Short-Term vs Long-Term Cashflow Forecasting: What’s the Difference?

Both short and long-term forecasting play critical roles in financial planning:

Short-Term Forecasting (Next 30 Days)

Used for day-to-day cash management. This helps businesses:

– Ensure they can cover payroll, supplier payments, and tax obligations.

– Avoid emergency funding like overdrafts or credit cards.

– Maximise the use of surplus cash (rather than letting it sit idle).

Long-Term Forecasting (Beyond 12 Months)

Tied directly to the business strategy, this type of forecasting helps with:

– Assessing funding needs for future growth.

– Understanding the financial impact of new hires or expansion plans.

– Maintaining strong liquidity and financial resilience.

Short-term forecasting keeps the lights on. Long-term forecasting keeps the business growing. Smart businesses use both.

Profit looks great on paper, but without structured cashflow planning, your business can still run out of money when it matters most.

Overcoming Common Cashflow Challenges

“Cashflow forecasting is like looking into a crystal ball.” Ever heard that?

Sure, no one can predict the future with certainty. But forecasting isn’t about being 100% right—it’s about being prepared.

Here’s how businesses can overcome common challenges:

– Automate Cashflow Tracking – AI and cloud-based tools remove manual guesswork and improve forecasting accuracy.

– Break Down Internal Silos – Finance teams need input from sales, operations, and leadership to create meaningful forecasts.

– Plan for Tax Before Spending – Allocating funds for tax obligations before spending prevents unexpected shortfalls.

– Train Your Team – Financial literacy isn’t just for accountants. Every department should understand its role in maintaining healthy cashflow.

So, Should You Be Preparing a Cashflow Forecast?

Short answer? Yes.

But more importantly, your forecast needs to be maintained, updated, and used. A neglected cashflow forecast is just another spreadsheet collecting dust.

A structured cashflow system will help your business:

– Anticipate cash crunches before they happen.

– Make strategic decisions with confidence.

– Unlock growth opportunities by managing cash proactively.

At the end of the day, cashflow forecasting isn’t about guessing the future—it’s about controlling it.

A cashflow forecast isn’t about predicting the future—it’s about controlling it. The businesses that plan for cash surpluses and shortfalls win every time.

Final Thought

The most successful businesses aren’t the ones with the highest revenue. They’re the ones that understand their cashflow.

If you don’t have a structured system in place for managing your cash, you’re making decisions in the dark.

The question is: How long can you afford to keep guessing?