You pour your heart, soul, and countless hours into your business. So why does it feel like you’re the last one to get paid? For many Perth business owners, the dream of freedom has been replaced by the pressure of ATO compliance, confusing financials, and the frustrating feeling that you’re paying far too much tax. You’re working harder than ever but not seeing the rewards in your own bank account.

It doesn’t have to be this way. Your accountant should be more than a reactive number-cruncher who just lodges your BAS. As strategic tax accountants in Perth, we believe your business should serve your life, not consume it. In this article, we’ll show you how to move beyond simple compliance to unlock your business’s true profit potential. You’ll discover how a proactive financial partner can give you clarity, legally minimise your tax, and help you finally pay yourself more.

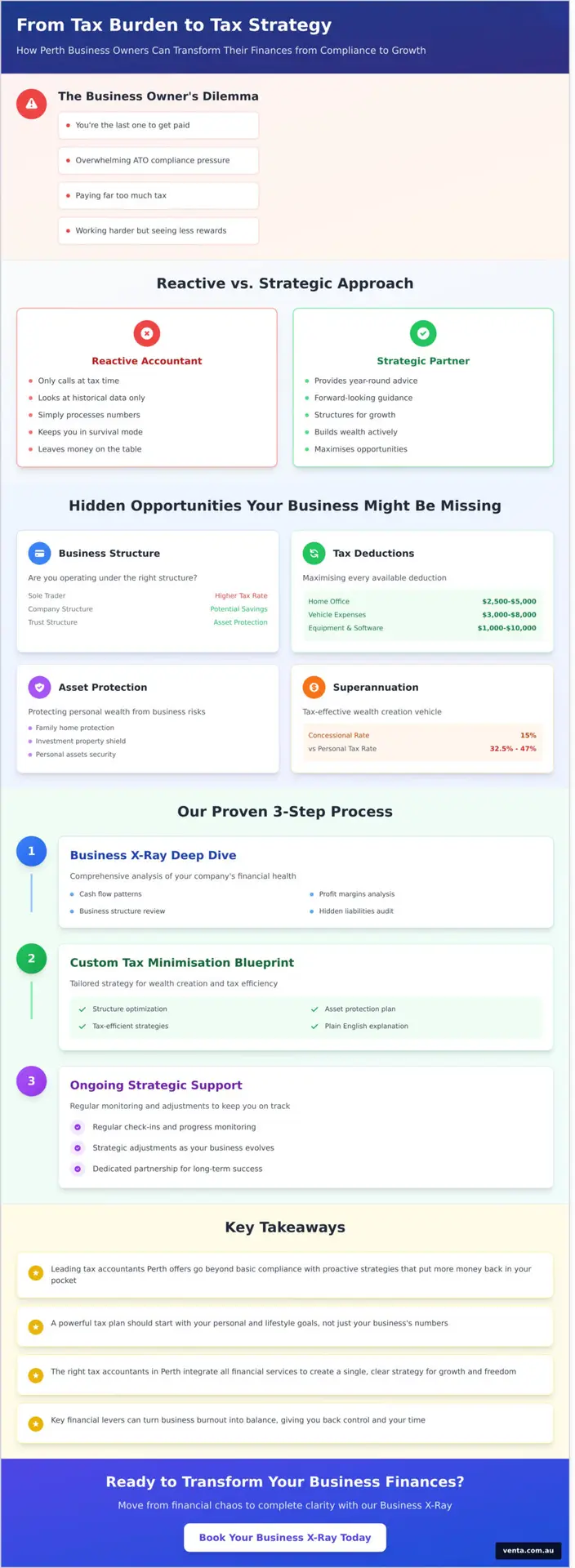

Key Takeaways

- Learn how the leading tax accountants Perth has to offer go beyond basic compliance with a proactive strategy that puts more money back in your pocket.

- Discover why a powerful tax plan should start with your personal and lifestyle goals, not just your business’s numbers.

- See how the right tax accountants in Perth integrate all your financial services to create a single, clear strategy for growth and freedom.

- Understand the key financial levers that can turn business burnout into balance, giving you back control and your time.

Beyond Compliance: The Difference a Proactive Perth Tax Accountant Makes

For many business owners, tax time feels like a necessary chore. You gather your documents, hand them over to an accountant, and they lodge your return on time. This is the ‘compliance trap’-doing the bare minimum to satisfy the ATO, but potentially leaving thousands of dollars on the table. It’s a reactive approach that keeps you stuck in survival mode, never getting ahead.

We believe your accountant should be your most valuable strategic partner. Their goal shouldn’t just be to keep you out of trouble, but to actively help you build wealth, minimise your tax obligations legally, and create the financial freedom you went into business for in the first place.

The Reactive Accountant vs. The Strategic Partner

A reactive accountant only calls you at tax time, looks at historical data, and simply processes the numbers you provide. A strategic partner, however, provides forward-looking advice throughout the year. We don’t just ask “what did you earn?”; we ask “how can we structure your business to help you earn more and keep more of it next year?”. This is the fundamental difference that separates a simple bookkeeper from the expert tax accountants Perth business owners rely on for growth.

Identifying Opportunities Your Business is Missing

A proactive advisor dives deep into your financial world to find hidden opportunities for growth and protection. They provide the clarity and confidence you need by asking the tough questions you might not even know to consider:

- Structure: Are you operating under the right business structure (sole trader, company, trust)? A change here could save you a significant amount in tax.

- Deductions: Are you maximising every available deduction and concession? Navigating the complexities of the Australian taxation system is a full-time job, and missed claims are missed savings.

- Protection: Is your personal wealth, like your family home, properly protected from business risks and liabilities?

- Superannuation: Could you be leveraging your superannuation more effectively as a powerful tool for tax-effective wealth creation?

Answering these questions is where real value is created-transforming your tax and accounting from an annual expense into a strategic investment in your future.

Our Proven Process: A Tax Strategy Built Around Your Freedom

Your business is unique, and so are your goals. That’s why a generic, one-size-fits-all tax return is never enough. We believe your financial strategy should be a direct reflection of the life you want to build-one with more freedom, less stress, and the breathing room to enjoy your hard work. Our process is designed to bridge the gap between where you are now and where you truly want to be, resulting in a clear, actionable plan to boost your profits and legally minimise your tax.

Step 1: The ‘Business X-Ray’ Deep Dive

Everything starts with clarity. Our signature ‘Business X-Ray’ is a comprehensive deep dive into your company’s financial health. The expert tax accountants Perth business owners trust on our team go beyond the surface numbers. We meticulously analyse everything from cash flow patterns and profit margins to your business structure and hidden liabilities. This process uncovers the risks holding you back and the untapped opportunities that can propel you forward.

Step 2: Building Your Custom Tax Minimisation Blueprint

Using the insights from your X-Ray, we design a tax minimisation blueprint tailored specifically to you. This isn’t just about compliance; it’s a proactive strategy for wealth creation. While the official guide to starting a business provides a great foundation on structure, our blueprint applies advanced, legal strategies to your unique situation for maximum tax efficiency and asset protection. We then walk you through the entire plan in plain English, ensuring you feel confident and in control.

Step 3: Ongoing Support to Keep You on Track

A powerful tax strategy is not a ‘set and forget’ document. As your business evolves, so should your financial plan. We provide regular check-ins and ongoing support to monitor your progress, navigate changes, and make adjustments as needed. You don’t just get an accountant; you gain a dedicated partner who is genuinely invested in your long-term success and personal freedom.

Ready to move from financial chaos to complete clarity? Book your Business X-Ray today.

Comprehensive Tax & Accounting Services for Perth Businesses

Juggling your business finances can feel like a constant battle against chaos. It’s more than just numbers on a page; it’s the pressure of compliance, the confusion around tax, and the nagging feeling that you could be doing more to grow your wealth. We believe your finances should empower you, not overwhelm you. That’s why we offer a full suite of services designed to integrate seamlessly into your overall business strategy.

As your dedicated tax accountants in Perth, our goal is to ensure every financial decision supports your primary goals. We help you move from feeling stressed and disorganised to feeling confident and completely in control of your financial future. It’s time to find your breathing room.

Business Tax & Strategic Planning

Tax is not just an end-of-year chore; it’s an opportunity. We focus on proactive tax planning to legally minimise your obligations and improve your cash flow throughout the year. Our experts provide strategic advice on the right business structure-be it a sole trader, company, or trust-to set you up for long-term success and protection. We handle the preparation and lodgement of all company and trust tax returns, ensuring you are always compliant and optimised.

BAS, GST, and ATO Compliance

Are ATO deadlines a constant source of stress? Let us take that weight off your shoulders. We manage the timely and accurate preparation and lodgement of your Business Activity Statements (BAS), so you never have to worry about missing a deadline again. Our team provides clear, expert advice on GST, Fringe Benefits Tax (FBT), and Payroll Tax. We act as your shield, managing all ATO communications so you can get back to focusing on running and growing your business.

Self-Managed Super Funds (SMSF)

Your superannuation is the key to your future freedom. An SMSF can offer greater control and flexibility over your retirement savings, but it comes with complex compliance rules. We provide end-to-end SMSF services, from expert advice on establishment and management to handling all annual compliance, financial statements, and tax returns. Our strategic guidance is designed to help you confidently build your retirement wealth and achieve your long-term financial goals.

Who We Work With: Empowering Perth’s Ambitious Business Owners

You’re an expert in your field. You built your business on skill, passion, and sheer hard work. But now, you feel stuck. The long hours, the constant pressure, and the financial chaos are leading to burnout. You’re starting to feel like the business is running you, not the other way around.

We see this every day. As specialist tax accountants in Perth, we partner with driven owners who are ready to trade survival mode for strategic growth. Our clients want more than just compliance; they want to build a profitable business that serves their life and gives them back their freedom. If you’re ready to take control and get the clarity you need to move forward, you’re in the right place.

Trades & Construction

You know how to manage a worksite, but unpredictable cash flow and complex paperwork can grind everything to a halt. We give you the financial tools to build with confidence. We help with:

- Mastering your cash flow so you can pay suppliers, staff, and yourself on time.

- Navigating complex ATO rules like the Taxable Payments Annual Report (TPAR).

- Implementing smart strategies for asset protection and equipment financing.

Professional Services

For consultants, engineers, and healthcare professionals, your expertise is your greatest asset. Our job is to ensure your business structure protects it and your profits reflect the value you provide. We focus on:

- Optimising your business structure for maximum tax efficiency and liability protection.

- Implementing powerful profit improvement strategies to ensure you’re paid what you’re worth.

- Creating systems that give you more time to focus on your clients, not your books.

Established Family Businesses

A family business is more than just a balance sheet-it’s a legacy. We understand the unique dynamics and emotional complexities involved, helping you protect what you’ve built for generations to come. We provide guidance on:

- Navigating the unique challenges and opportunities of a family-run enterprise.

- Developing clear succession plans and tax-effective wealth transfer strategies.

- Ensuring the business provides lasting security for both current and future generations.

We are proud of the life-changing transformations we have helped create for business owners across Perth. See how we’ve helped businesses like yours.

Ready to Pay Yourself More? Your Perth Partners are Here.

You built your business with ambition and hard work; your financial strategy should reflect that. The right approach goes far beyond simple compliance-it’s about creating a proactive plan that puts your personal freedom and financial reward first. It’s about trading chaos for clarity and turning your hard-earned revenue into a life you love, not just a business that survives.

As five-star rated tax accountants Perth business owners trust, we specialise in proactive tax minimisation and strategic business advisory. We believe your business shouldn’t cost you your freedom. Our entire goal is to give you the visibility and control you need to not only grow your business but to significantly increase what you take home.

The clarity and breathing room you deserve are just one conversation away. Stop feeling stressed by tax. Book a call to discuss how we can help you pay yourself more. It’s time to partner with a team dedicated to your profitability and peace of mind.

Frequently Asked Questions

How much do your tax accounting services in Perth cost?

We believe in transparent, value-based pricing, not surprise bills. Because every client’s situation is unique, we provide tailored, fixed-fee packages starting from A$250 per month. This approach ensures you get the exact support you need to achieve your goals without financial stress. We see our services as an investment in your freedom and clarity, providing a clear return by helping you keep more of the money you work so hard to earn.

Why shouldn’t I just use a cheap online tax lodgement service?

Cheap online services focus on one thing: basic compliance. They are a tool for lodging, not for growing. They won’t help you find breathing room, improve cashflow, or create a strategy to pay yourself more. We act as your strategic partner, moving beyond simple lodgement to provide the advice and foresight needed to transform your business from a source of stress into a vehicle for the life you want to live.

Do you only work with businesses, or can you help with personal tax returns?

We help both business owners and individuals. For our business clients, we believe in a holistic approach. Your business finances and personal wealth are deeply connected, and managing them together allows us to build a more effective strategy. This complete financial picture ensures every decision we make is aligned with your ultimate goal: creating a business that serves your life, not the other way around.

My books are a mess. Can you still help me?

Absolutely. Feeling overwhelmed by financial chaos is one of the most common reasons clients first come to us. Please don’t feel embarrassed; our job is to bring clarity, not judgment. We’ll start with our ‘Business X-Ray’ to diagnose the situation and create a clear, simple action plan to get you organised and back in control. We thrive on turning financial mess into financial mastery for our clients.

How do I switch from my current accountant to Venta Belgarum?

Making the switch is surprisingly simple and completely stress-free for you. Once you decide to partner with us, we handle the entire process. We will professionally contact your previous accountant to arrange for the secure transfer of all your historical files and information. It’s a standard industry procedure, meaning you avoid any awkward conversations and can focus on the future while we take care of the background details.

Are you actually located in Perth?

Yes, we are proud to be a local Perth-based accounting firm. Our team lives and works here, giving us an intimate understanding of the Western Australian business landscape. Being local means we’re more than just service providers; we are part of your community. When you need expert tax accountants in Perth who truly get the local market, you can count on us to be right here with you.